Forex Trading for Beginners

What is the forex trading market?

The trading of currencies is also known as the foreign exchange market. This agency’s rarest aspect is its need for more specific market space. It needs a proper marketplace. But the currency trading happens virtually over the counter. The trading is all taking place on the computer and online, so the location and center haven’t yet been determined, which means that all of the trading will take place online.

The marketplace operates five and a half days a week, 24 hours a day. Forex trading for beginners is the leading financial hub of Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich, which are the global hubs for currency trading, spanning nearly all time zones. That implies the currency market opens in Tokyo and Hong Kong after the U.S. trading day concludes. With price quotes fluctuating constantly, the currency market can be joyful at any moment.

How does it work?

The FX market is the only wholly continuous and nonstop trading market globally. In the past, big banks and institutional investors acting on behalf of their clients controlled the currency market. Forex trading for beginners is relatively easy to learn. In recent years, however, it has shifted from a more institutional focus to that of a more retail one, with traders and investors of all sizes contributing to the market.

What is this, and who trades on it?

There is something curious about the global currency markets in that there is no actual building that is used as a trading location. In its place, it is a network of interconnected computer networks and trade terminals that communicate with each other. It is estimated that the majority of market participants are institutional investors, international individual investors, investment banks, and commercial banks.

Before trading in currencies became available online, it took a lot of work for private investors and forex trading for beginners. Because forex trading requires substantial capital, most currency traders were huge multinational organizations, hedge funds, or wealthy people. Most forex market trading is still done by investment and commercial banking institutions on behalf of their customers. Professional and private investors can, however, also exchange a single currency for a different one.

What is Forex trading?

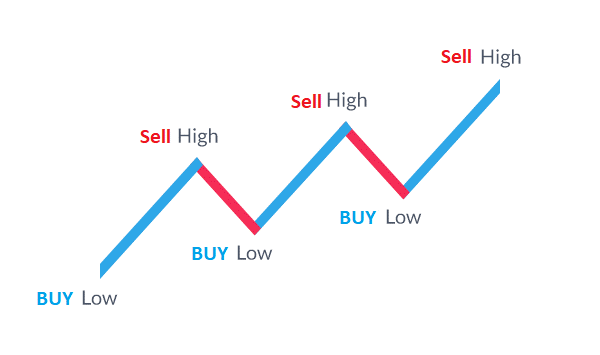

Forex trading for beginners, or FX trading, is purchasing and selling different currencies to make a profit. Capturing the changing values of currency pairs is the fundamental goal of forex trading. For instance, a speculator may purchase Euros using Dollars if they believe the worth of the Euro will rise compared to the US currency. If there is a relative increase in the value of the Euro (the EUR/USD rate), you can sell your Euros back for more Dollars than you originally paid, which will result in earnings.

Forex trading for beginners is utilized not only for speculative motives but also for hedging. Individuals and companies use forex hedging to safeguard themselves against unfavorable currency fluctuations, also called currency risk. For instance, a business operating overseas may utilize forex trading as a hedge against any losses brought on by changes in the currency’s value overseas.

By securing a favorable rate through a forex transaction, they can lower the likelihood of financial instability and guarantee more consistent income or expenses in their currency. This feature of forex trading is essential for multinational corporations looking to maintain stability in their financial planning. Because forex trading for beginners is a truly global industry that spans financial hubs across the globe, many international events impact currency values.

Economic factors can significantly affect currency prices, including inflation, interest rates, economic development, and stability in geopolitics. For example, a nation’s currency may appreciate if its central bank increases interest rates because investments denominated in that currency will yield higher returns. Likewise, a currency’s devaluation may be caused by political unpredictability or an unfavorable forecast for economic growth. Because of its global interconnectedness, forex trading is a reflection of global political and economic dynamics in addition to being a financial activity.

We can start learning about the forex trading by following these steps:

- Start learning about forex

- You have to set up the Brokerage account

- Create the trading strategy

- Try to be on top of your number

- Manage the emotional equilibrium

Research currency Pairs and time to learn

It can be challenging for a newbie to learn forex trading for beginners, so spend some time in Future Invest to learn about the different markets, words, odds, and techniques. Your Best Forex Broker (Invest Future) will be able to provide you with information about online courses, videos, and training materials that you can take. There are several courses available on forex trading that you can choose from if you would like to learn more.

Understanding currency pairs is essential before you start learning to trade. Invest Future know which opportunities to ignore and which ones offer the best return on investment, there are plenty. For instance, the EUR/USD pair is regarded as one of the most stable and is a fantastic place to start. The EUR/USD pair, consisting of the Euro and the US Dollar, stands out as a particularly noteworthy starting point for traders, especially beginners.

You can start trading more volatile combinations once you are more accustomed to working with different currencies, like in Future Invest. Keeping an economic calendar close at hand is also a brilliant idea if you want to remain on top of announcements and news and anticipate price changes.

Summary

You ought to know the steps involved in beginning FX trading. Spend time with us to learn about methods, select a trustworthy broker, and use your sample account for practice. Be bold, use internet tutorials and instructions, and explore currency combinations to choose the best option. You can eventually move to a real money account once you’ve mastered the art of making consistent profits.

Recall to trade with discipline and always have a plan for managing your risks. You will successfully master forex trading for beginners if you follow through. Are you curious about related finance topics? Then, to improve your abilities, look into our equity research training course.